Nowadays, people are struggling to pay their medical bills. According to a recent survey from The Commonwealth Fund, the situation is pretty serious. It shows that 41 percent of working-age Americans—roughly 72 million people—are dealing with medical bills or working to pay off medical debt.

These numbers underline the importance of options that make necessary treatments more affordable. Thankfully, many healthcare providers now offer patient financing solutions to make their services accessible. These solutions can be a real game-changer for those facing high medical costs.

Before we explore further, let's talk about how medical debt impacts people and the issues with the current healthcare payment system.

Consequences Of Medical Debt That Call For Action

| National Health Expenditure data by the Centers for Medicare & Medicaid Services shows, that in 2019, the average American household spent almost $5,000 per person on healthcare. By 2022, that cost had jumped to $13,493 per person. |

Medical debt is a massive issue that affects not just individuals but also the whole country. Even though most people in the U.S. have health insurance, they still have to pay more out of pocket, like higher deductibles and copays.

Beyond question, not everyone can afford medical expenses, so the bills just pile up. In contrast, those who pay it by themselves, end up cutting back on essentials like food and clothing and drain their savings to pay off bills. When discussing families with limited income, even a small, unexpected medical bill can feel overwhelming. Moreover, for those facing major medical needs, the debt can just keep piling up over time.

Discover the best practices for patient payment plans to improve your practice's financial health.

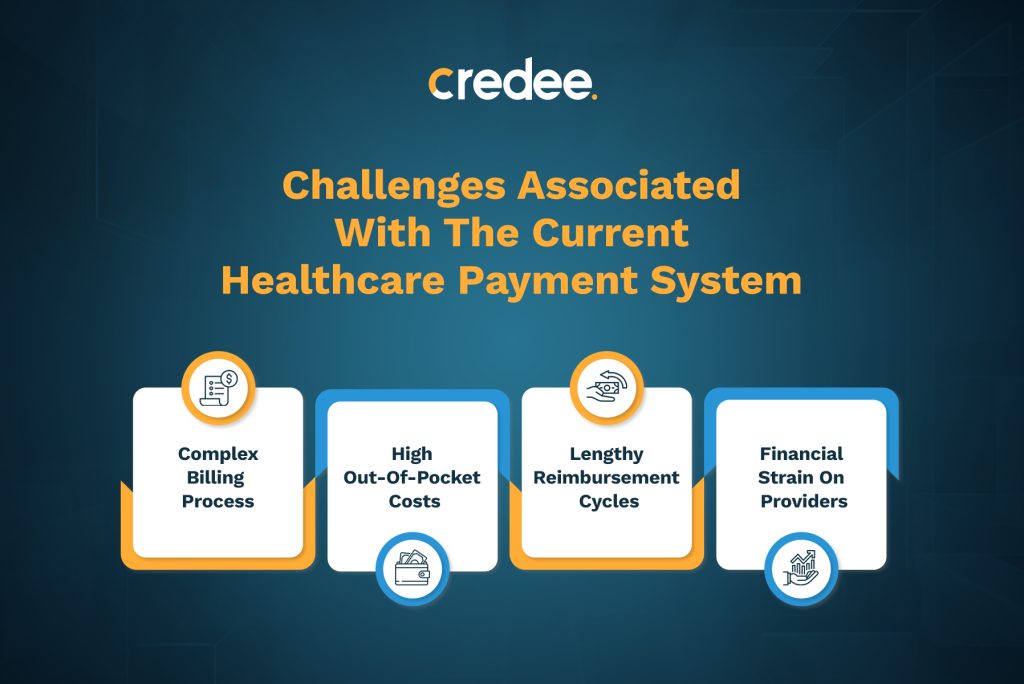

Challenges Associated With The Current Healthcare Payment System

The US healthcare payment system is complex and multifaceted, presenting various challenges. Some of them include:

1. Complex Billing Process: The billing process confuses and reduces patient trust in their healthcare provider. As a result, this often impacts overall business performance.

2. High Out-of-Pocket Costs: Increased deductibles, co-pays, and uncovered services place a significant financial burden on patients. Therefore, many patients don’t seek out treatments, reducing the provider's patient base.

3. Lengthy Reimbursement Cycles: Insurance companies often delay reimbursements to providers. It disrupts their cash flow and financial stability. Consequently, providers request patients to make cash payments or pay the full amount upfront.

4. Financial Strain On Providers: The hurdles in the current system affect the quality of care. It's not just about efficiency—it also puts their profitability and future growth plans at risk.

Given the critical importance of healthcare, it's crucial to address these challenges. While solutions vary in scope and feasibility, the overarching goal is the same: to create a payment system that provides everyone with accessible, high-quality, and affordable care.

Patient Financing Solutions

A proactive approach that has a positive outcome for everyone involved.

| 50% of patients between the ages of 18 and 54 have opted to utilize payment plans for managing their healthcare payments. |

For patients: They help patients get the treatments they need by spreading the cost in easy payments. In addition to this, when financial worries are eased, patients are more likely to stay on top of routine check-ups and medication plans.

For providers: When more people are willing to seek treatments, healthcare providers gain a larger group of potential patients, leading to increased revenue. However, practices often deal with challenges like negative cash flow, debt recovery, and staff costs. Offering financing options can really help with these issues. On top of that, you can attract new patients and keep current ones by offering financing for important treatments.

Benefits Of Offering Patient Financing Solutions For Providers

These solutions contribute to better health outcomes and a more sustainable healthcare system.

Mentioned Below Are Its Benefits:

1. Improvement In Cash Flow: Ensures more timely payments, enhancing the financial stability of healthcare practices.

2. Enhancement In Patient Satisfaction And Loyalty: Patients are more likely to follow through with treatments and visit their healthcare providers when they have less financial barriers.

3. Reduction In Administrative Burden: Simplifies billing and collection processes, freeing up the staff to focus on patient care.

4. Better Health Outcomes: Facilitates timely access to medical care, leading to improved health outcomes by preventing delays in treatment.

5. Improvement In Utilization Of Preventive Services: Encourages patients to seek preventive care, reducing the likelihood of more severe health issues and higher costs in the future.

6. Support For Uninsured Or Underinsured Patients: Healthcare providers can support patients who lack adequate insurance coverage, ensuring they receive the necessary care.

Enhance Patient Care With Flexible Payment Plans!

Provide affordable care solutions and grow your patient base.

Discover HowHow To Implement A Patient Financing Solution In Your Practice

Firstly, healthcare providers should assess their current financial landscape and patient demographics. It is important to understand the specific challenges and opportunities.

Secondly, providers should clearly communicate the availability and benefits of financing options to their patients.

Third and most importantly, training staff members about the policies of the financing options is crucial for successful implementation.

| Pro Tip: Keep your patients up-to-date with any changes in the financing options policies. |

Factors To Evaluate When Selecting An Ideal Patient Financing Solution:

- Features to customize the payment options to improve flexibility to pay.

- Easy application process.

- Approval percentage of patients with low credit scores to increase accessibility.

- Payment management features including debt collection and payment reminders.

Introducing Credee Payment Plans

A Great Way To Implement And Offer Patient Financing Solutions For Healthcare Practices.

1. Provides Flexible Payment Plans:

With Credee, you can enable your patients to decide the period over which they can complete their payments. This makes your services more affordable and accessible.

2. Improves Cash Flow For Providers:

Credee facilitates protected payments, ensuring you receive payments on time. Thereby, it improves cash flow and maintains financial health for your practice.

3. Reduces Administrative Burden:

It automates the billing and debt collection process, reducing the administrative workload. This allows providers to allocate more resources and staff toward patient care.

4. Enhances Patient Experience:

Patients are more likely to seek necessary treatments when they know they have flexible payment plans.

| Why Choose Credee Over Other Financing Options? - Flexible Payment Plans To Offer - No Credit Check - 97% Approval Rate - Effortless Website Integration - Easy Debt Collection - Multilingual Support |

The Final Words

It is evident that there's a gap between patients’ payment expectations and the reality. However, turning this gap into a golden opportunity is in your hands. By offering patient financing solutions, you can build stronger relationships with your patients. It positively shows that you care about their well-being beyond just medical treatments. Consequently, this leads to increased patient satisfaction, better communication about treatment plans, and improved patient outcomes.

With Credee, you can give your patients the financing options they need to get necessary care. And the best part? There's no immediate financial pressure on your patients. This support is crucial for ensuring everyone can access essential healthcare services. Plus, it saves on administrative costs and frees up your staff from the hassle of manual billing and debt coll process.

Want to see how Credee works? Book a demo and see how easily Credee’s patient financing can integrate into your system.

Frequently Asked Questions (FAQs)

1. How Can Patient Outcomes Be Improved?

Improving patient outcomes involves making sure patients get the best possible care and support. It includes:

- Enhancement of patient education and communication.

- Utilization of advanced technology.

- Focus on preventive care and early intervention.

- Patient-centered care and empathy.

- Financing solutions to improve accessibility.

2. Why Is Healthcare Finance Important To A Healthcare Organization?

With healthcare financing, organizations can plan for new equipment and better care for patients. Moreover, they can access how to grow to meet the needs of more people who need healthcare. It's about making smart decisions with money to make sure hospitals can keep helping patients for a long time.

Ready to see how our patient financing solutions work?

Schedule A Demo Today